Table of Contents

Sell a Home in Chapter 13 Bankruptcy: Motion to Sell or Refi

My clients ask me, “can I sell a home in a Chapter 13 bankruptcy?” As a bankruptcy attorney experienced in Chapter 13, selling a house is an issue that comes up often, particularly in a robust housing market. This is written without giving advice to the specifics of your case, but merely addressing whether it’s possible to sell or refinance a house during Chapter 13.

The answer is “yes… but.” It’s not always in your best interests to sell a home in Chapter 13, and you really should consult on this with your bankruptcy lawyer, as facts vary depending on judicial circuit, state, local practice, and your particular case and its Order Confirming. As I’m a Los Angeles bankruptcy attorney, I’ll be focusing on practice in the Central District of California here in the Ninth Circuit, so the following may not apply to you if you’re elsewhere.

Can I move during a Chapter 13 bankruptcy?

Let’s start with the basic question of whether you’re allowed to move and change residence during the term of a Chapter 13. The answer is, “Yes.” There is nothing in a bankruptcy that prevents you from moving, or even changing states. You are free to move about the country.

As leaving the state would likely mean you’re now working out-of-state from where the case was filed, you will almost certainly want to update your Schedules with your new employer, income and expenses, and this may potentially affect your plan payment, and the percentage of debt which you’re paying the general unsecured creditors. And that may turn into a Motion to Modify (MoMod) being filed with the court, leading to new legal fees.

Motion to Sell or Refinance in Chapter 13

A Motion to Sell or Refinance in Chapter 13 is where you ask the judge permission to sell or refinance your home. So, yes, you can sell or refi in Chapter 13. Whether it’s a smart decision or not will vary based on the circuit, district, and even your particular case, and you’ll want to seek advice with your bankruptcy lawyer.

Chapter 13 can pay only a fraction of your debts. But that can trigger a couple of things that lead to it getting fed more money. If you’re paying less than 100% of the general unsecured creditors, sometimes you don’t get to keep tax refunds in Chapter 13. Similarly, when there is a ton of extra money from a home sale or refi, that too can lead to more debt getting paid.

Revesting of the Estate and Form Plans

Revesting

One factor as to whether you should sell a home in Chapter 13 (or refinance in your Chapter 13 bankruptcy) depends on whether the estate revests at confirmation or at discharge. That’s all a fancy way of saying, “when does the ownership and control of your stuff — including your home — return to you, the debtor?”

In bankruptcy, here’s the crux of the matter: when you sell or refinance in a Chapter 13, do you have to use the sale proceeds to pay all of your general unsecured debt, or all of the part you are intending to pay during the bankruptcy? Remember, Chapter 13 bankruptcy doesn’t necessarily pay all your debt. If a Chapter 13 is only paying a fraction of the credit cards, how much of the credit cards get paid by the proceeds of the house or other sale?

A recent case on postpetition equity

The issue as to whether you can sell in a Chapter 13 and who gets the proceeds was recently seen in Colorado, when the Chapter 13 trustee fought to get the postpetition appreciation of an LLC. In re Klein, WL 3902822 (Bankr. D. Colo. 2022). The trustee argued that proceeds were postpetition property under Section 1306 (nothing about 541a6). However, debtor argued that Section 1327 says that property vests in the debtor at confirmation, unless provided otherwise in the plan. The two sides fought about the tension between 1306 vs 1327. Ultimately, the Court concluded that 1327 was more specific and the proceeds belonged to Debtor.

What about Section 1322(b)(9)? That says the plan may “provide for the vesting of property of the estate, on confirmation of the plan or at a later time, in the debtor or in any other entity.” That “may” (coupled with 1327b) also indicates that it may not.

More on that later.

This is the Tenth Circuit. What about here in the Ninth Circuit?

Black vs Leavitt (In re Black)

Glad you asked. That’s the issue the Ninth Circuit Bankruptcy Appellate Panel faced in 2019 in Black vs Leavitt (In re Black), 609 B.R. 518 (9th Circuit BAP, 2019). There, the BAP decided that when someone tried to sell a home in a Chapter 13 (actually, a rental property), the property — and the proceeds — were the debtor’s to do as he wanted.

In our view, the revesting provision of the confirmed plan means that the debtor owns the property outright and that the debtor is entitled to any postpetition appreciation. When the bankruptcy court confirmed Mr. Black’s plan, the Property revested in Mr. Black. See In re Jones, 420 B.R. at 515. As such, it was no longer property of the estate, so the appreciation did not accrue from estate property.

Id. at 529.

Great news, right? Not so fast. There’s some key language in footnote 9 of the same case. There, the 9th Cir BAP wrote:

If the plan did not vest the Property in Mr. Black, the result would likely be different. See Klein v. Chappell (In re Chappell), 373 B.R. 73, 83 (9th Cir. BAP 2007), aff’d sub nom. Gebhart v. Gaughan (In re Gebhart), 621 F.3d 1206 (9th Cir. 2010) (In a chapter 7 case, where property does not revest in the debtor, “[u]nder well-settled Ninth Circuit law, any postpetition appreciation in value in the residence in excess of the maximum amount permitted by the exemption statute invoked inures to the benefit of the estate.”); § 541(a)(6) (a bankruptcy estate includes “[p]roceeds, product, offspring, rents, or profits of or from property of the estate ….”).

Clearly, the issue of who gets the sale proceeds is determined by what the Chapter 13 plan says. It’s important to know this crucial fact before asking your bankruptcy attorney to submit a motion to sell or motion to refinance real property.

In re Berkley

In one case, the debtor was repaying one percent (1%) of his unsecured debt. The plan said the estate revests at confirmation. After the case was confirmed, he started getting stock options. At month 57 of his plan, he sold his postconfirmation stock options for $3.8 million. Trustee filed a motion to modify for some of the sale proceeds. The Ninth Circuit BAP held that Section 1329 and a modification allows for change of circumstances, and the millions of dollars means that debtor can repay his debts.

The 9th Circuit BAP acknowledged that the estate terminated at confirmation, citing 9th Circuit precedent of In re Jones, 420 BR 506 (9th Cir BAP 2009), aff’d by 9th Cir in 657 F3d 921 (9th Cir, 2011). In Jones, the Ninth Circuit adopted the “estate-termination approach.” This approach is where the estate ceases to exist at confirmation. In the estate termination approach, all property then becomes property of the debtor, whether acquired before or after confirmation.

The Berkley BAP then nodded at its own recent ruling in the matter of In re Black (above).

However, the BAP then held that “[u]nder § 1329, the bankruptcy court can approve a plan modification that increases the debtor’s plan payments due to a postconfirmation increase in the debtor’s income, whether or not the additional income is property of the estate.” In re Berkley, 613 BR 547, 553 (9th Cir BAP, 2020). It distinguished Black and Jones from the instant case, as it is solely concerned with postpetition wages.

Central District Form Plan

Whether the estate revests at confirmation or at discharge is a key determining factor about who gets the sale proceeds of postpetition appreciation from a prepetition asset. So what does the form plan say here in Los Angeles County, in the heart of the Central District of California?

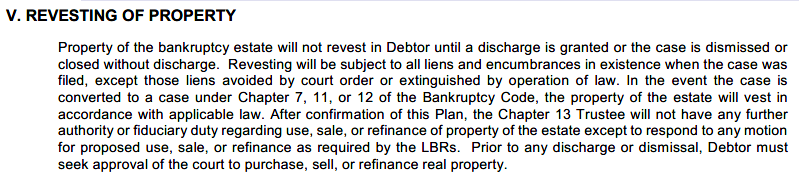

Locally, here in the Central District of California, the estate doesn’t revest in the debtor until discharge. We know this because this is what our Chapter 13 form plan says. Your mileage may vary.

There is the key language that controls when you sell a home in Chapter 13 bankruptcy in most cases in the Central District of California when there is a Motion to Sell or Refi with proceeds. It means that the debtor and proceeds must not only pay “all of the plan” debt, but “all of the all” debt. This can be a strong disincentive. It often is better to just stay in the Chapter 13 until discharge, and get forgiveness of potentially tens of thousands of dollars of unsecured debt. After discharge, the house, and what you do with the proceeds, are yours.

Now, I supposed there is nothing preventing debtor from adding a nonstandard provision to the plan that debtor’s property revests at confirmation. But that may lead to other hazards that involve the automatic stay and debtor’s property which are no longer property of the estate. Try this at your own peril.

Conclusion

So, yes, Virginia, you call sell a house in Chapter 13 bankruptcy. You have the right to move cities, even states, as long as you maintain your plan payments, and update your schedules to reflect current income and expenses. However, who gets the sale proceeds is very specific to where you live, what your appellate courts say, and what your local district’s forms say. As always, ask your bankruptcy attorney, and thank you for reading.