Table of Contents

Liens in Bankruptcy: The Ultimate Guide, Explained

Liens in bankruptcy typically survive and don’t get affected by the discharge. However, there are exceptions where the lien can be reduced or even eliminated. I try to break these down in simple terms that are easy to grasp. But don’t be fooled: bankruptcy is more complicated than you think. Get a consultation with an attorney, and make sure you check out my list of 12 crucial tips to do or avoid before filing bankruptcy.

What is a Lien in Bankruptcy?

A lien is a security interest of a debt that encumbers a thing owned by the borrower until the debt is paid. One common example is a car and the car loan. The borrower who “owns” a car can’t just sell the car outright. He has to pay the debt secured by the lien against the car first. Then, once the debt is paid, the lien is satisfied and removed.

Section 101(37) of the Bankruptcy Code defines “lien” as:

charge against or interest in property to secure payment of a debt or performance of an obligation.

How does bankruptcy affect a lien? The General Rule

The general rule for liens in bankruptcy (and there are exceptions) is that bankruptcy doesn’t affect a lien at all. If a debt is secured by a lien and collateral, if you wish to keep the asset, then that debt will survive the bankruptcy. You don’t get a free house or car in bankruptcy. Here, let me put that in a fancy quote because it is so important:

You don’t get a free house or car in bankruptcy.

– Attorney Hale Andrew Antico

There is a reason this is emphasized so strongly. For some reason — be it wishful thinking or confusion because the lender stopped sending statements or something else — people sometimes stop paying for a house or car. This is a mistake that can result in foreclosure or repo.

If you wish to keep the thing with a lien in bankruptcy (e.g.: your house), then you must continue to making regular payments on the loan or loans that goes with it. With that general principle out of the way, there are some specific exceptions or applications.

Chapter 7 bankruptcy and Liens

How does bankruptcy affect a lien in Chapter 7?

Chapter 7 bankruptcy is the simpler bankruptcy. You don’t normally pay unsecured debts back here. But how does bankruptcy affect a lien in a Chapter 7? The short answer: liens don’t go anywhere. If you started a Chapter 7 with a debt secured by a lien, you will most likely end the Chapter 7 with a lien. Nothing changes. Let’s look at a few different things that come up.

Vehicles in Chapter 7: You don’t get a free car

Repeat after me: In Chapter 7 bankruptcy, you don’t get a free car. If you are financing a vehicle, if you want to keep the vehicle, you must keep paying the loan. No matter what happens, you must keep current and paying for the car (or truck or RV or quad or other secured vehicle) if you want to keep it.

If your bank turns off your online access, you must keep current and paying for the car if you want to keep it. If your bank stops sending you statements or coupons, you must keep current and paying for the car if you want to keep it. If aliens abduct your Aunt Nana, you must keep current and paying for the car if you want to keep it.

You must be wondering why I’m spending three paragraphs repeating something that seems quite basic. You know, the concept that you must keep current and paying for a vehicle if you want to keep it. This is because no matter how obvious, no matter how many times this is repeated, people still somehow stop paying for their vehicle because they read on some message board on Google Esq. that they get a free car in bankruptcy.

But that’s false. You know why? Because there’s a lien on the car. And it remains. Why?

Because you don’t get a free car in Chapter 7 bankruptcy.

Reaffirmation Agreements in Chapter 7

Definition of Reaffirmation Agreement

A reaffirmation agreement is an agreement where you … reaffirm a debt. This has the legal effect of you promising to owe a debt after the bankruptcy, no matter what. I think we can all agree that vowing to be liable on a debt regardless of what happens after a bankruptcy is the opposite of what bankruptcy is supposed to be.

Why on earth would someone say, for example, yes, please, make me owe my mortgage balance even if I ever lose my house to foreclosure? You wouldn’t. Because that’s crazy. That’s what a reaffirmation agreement is: a contract where you make yourself owe a debt after the bankruptcy, regardless of what surprises the future throws at you.

That is crazy. Why would I ever sign a reaffirmation agreement?

Good question. You would never voluntarily promise to undo the bankruptcy for a debt on which you are trying to avoid personal liability. Again, it defeats the purpose of bankruptcy to say yes, I’d like to owe this debt after bankruptcy.

Bankruptcy is intended to get you out of debt. Reaffirmation agreements are intended to get you back into debt.

But you just told me I’ll owe the car debt after bankruptcy no matter what.

Not quite. The example above is just talking about payments for a car that you intend to keep. If you want to keep the car, pay for it on time. What we’re talking about now is the possibility you lose the car or house or RV after the bankruptcy.

Let’s say a year after the bankruptcy is done, an asteroid hits your employer and you lose your job and the can’t pay for the house or car. They repo or foreclose and you lose the thing, right? Right.

But if you signed a reaffirmation agreement, you not only lost the house or car, but you also owe for the contract for the house or car you no longer have. Why? Because you signed a reaffirmation agreement. Can we agree that’s a bad outcome?

Holy cow, that’s terrible. Why would I ever sign a reaffirmation agreement?

You wouldn’t voluntarily sign a reaffirmation agreement unless you had to. And for vehicles, if you want to keep the collateral, you need to stay current on payments and you need to sign a reaffirmation agreement if they send one to you. For mortgages, you don’t generally need to or want to sign one. Any lender that tells you you needed one during your bankruptcy is mistaken, lying, or evil. Probably just mistaken.

Note: the law changed in California in 2023 to bring back bankruptcy ride-through. SB1099 will make it no longer a default on a car loan if you don’t sign a reaffirmation agreement for a vehicle.

522f Lien Avoidance in Chapter 7: Judgment Liens

Recap of the rule: liens in Chapter 7

The rule for liens and lien avoidance in Chapter 7 bankruptcy is that the lien doesn’t go anywhere and you don’t get a free house or car in Chapter 7. If you started Chapter 7 with a lien on your car or a second mortgage on your house, you will likely end the bankruptcy with one, as there usually is no lien avoidance in Chapter 7. There can be one exception to this, and you have to qualify for it, contract for it, and yes, usually pay for it: judgment liens.

Possible Exception: What is a Judgement Lien

A judgment lien is when someone sues you, and as a result of the lawsuit, the judge rules against you. As a result, there is a now judgment against you. One way to collect on a judgment is a judgment lien against real estate or property you own or have an interest in. In California, the judgment lien cannot foreclose on you and take your house. However, it can sit there and grow with interest until you sell, refinance, transfer, or otherwise try to change the title. Then, it needs to get paid in full.

Oh no. What is a Judgment Lien Avoidance in Bankruptcy?

A judgment lien avoidance is where, in some cases, you can remove, or avoid, the judgment lien in bankruptcy… even Chapter 7 bankruptcy. Yes, it’s possible in Chapter 7 bankruptcy to avoid a judgment lien. However, it is not possible in every case, and doesn’t happen automatically. It’s extra work, and unless you contract for (and pay extra for) this extra work, the judgment lien avoidance won’t happen. Plus, the calculations around your home equity and lien amounts have to be right to qualify for it.

What are the factors to qualify for Judgment Lien Avoidance?

To qualify for lien avoidance in bankruptcy, we turn to Section 522(f) of the Bankruptcy Code, which says, in part: “the debtor may avoid the fixing of a lien on an interest of the debtor in property to the extent that such lien impairs an exemption to which the debtor would have been entitled.”

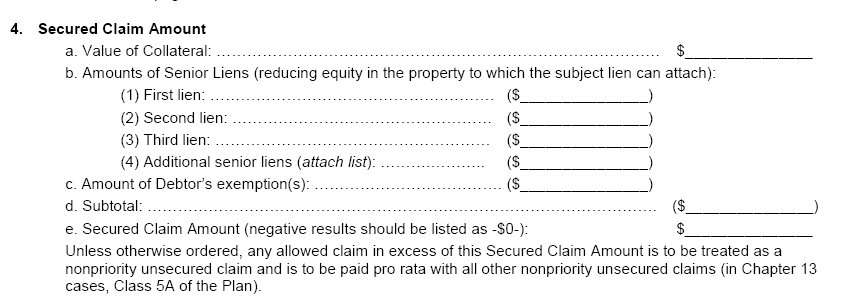

So, for judgment lien avoidance, you need to determine if the lien impairs an exemption. At its core, this is a simple math problem. Here, in the Central District of California, the form we use spells it out pretty clearly, as you can see below.

The factors are pretty self-explanatory:

- Value of Collateral: that’s what the house is worth

- First lien: this is usually the primary deed of trust, or first mortgage

- Amount of Debtor’s exemption: the amount of the exemption Debtor is entitled to

Lien Avoidance Formula: Take the value of the collateral, then subtract the debtor’s liens which cannot be avoided, and then subtract the exemption amount. That’s the amount that remains to pay judgment liens.

Still, this can be confusing. Read on!

522(F) Judgment Lien Avoidance Calculator

Below is a judgment lien avoidance calculator to help with the math of determining whether a judgment lien is impairing an exemption per 11 USC 522(f). You can only avoid the lien up to the amount it is impairing the exemption. If there is only partial impairment, there can only be partial judgment lien avoidance.

Timing of amounts used for lien exemption

If you learned of a judgment lien now but had an old bankruptcy where you didn’t avoid it, you may still be able to avoid the old judgment lien using the old bankruptcy. But exemptions change over time. Which home value and exemptions amount do you use?

- If reopening an old case, the Ninth Circuit law is to use exemptions at the time of the bankruptcy filing, even if the exemption amount is higher now.

- If filing a new case, Ninth Circuit law is to use the current exemptions even if the lien attached during the old exemptions.

Chapter 13 Bankruptcy and Liens

Section 506: Lienstripping a junior mortgage, mortgage cramdown, or avoiding a second mortgage lien

What Does the lienstripping law say?

There are really a few sections to focus on. First, section 506(d) of the Bankruptcy Code states, generally:

To the extent that a lien secures a claim against the debtor that is not an allowed secured claim, such lien is void

Making a lien void is a very good thing, and in Chapter 13 bankruptcy this can sometimes be done. The problem is it can’t be done all the time; the circumstances — and the math — have to be just right. Sometimes Sections 506(a) and 1322(b)(2) come into play in helping define what is secured.

The 9th Circuit BAP clarified when this can be done in In re Lam, 211 BR 36 (9th Cir BAP, 1997). It was in this major ruling when the Bankruptcy Appellate Panel ruled, “The Nobelman decision holding that section 1322(b)(2) bars a chapter 13 plan from modifying the rights of holders of claims, secured only by the debtor’s principal residence, does not apply to holders of totally unsecured claims.” Id. at 41.

So, the key language in Lam is “totally unsecured.” Unlike avoiding a lien under 522(f) which can allow partial removal of a judgment lien, avoiding a consensual lien like a deed of trust or mortgage cannot be partially secured. “…a one dollar difference in property value could have a profound effect on a secured creditor’s rights.” Lam at 41. So the evidence for property value is key, and this can be where all the fight is.

Lam Lienstrip Examples

Let’s say Debtor has a home valued at $200,000 with a first mortgage of $225,000 and a second mortgage with a balance of $50,000. Because the second isn’t “touching” the secured house, it is totally unsecured and can be avoided with a lien-strip in a Chapter 13 bankruptcy. However, if that same property were valued at $230,000, then there’s about $5,000 of secured status for the junior mortgage. That’s enough to make it a secured claim, and then, because it’s not wholly unsecured, it cannot be avoided or lienstripped.

I made a handy calculator where you can test out the above lien stripping examples yourself, and of course, your own numbers to see if it’s totally unsecured and qualifies in the Ninth Circuit for lien avoidance under Lam.

If you are in the Los Angeles, Ventura, or Orange County, contact me and let’s go over your options.

Section 522(f) and Judgment Liens in Chapter 13 bankruptcy

Judgment liens, where for example, a credit card won in court against you and then liened your home, can be avoided in Chapter 13 if they impair an exemption. While there can be a huge benefit to removing a judgment lien in Chapter 13, it also wouldn’t be necessary if it’s a 100% plan. In other words, if you’re paying all your unsecured debt back, turning a secured debt to an unsecured one wouldn’t provide a whole lot of benefit but would increase legal fees. For a discussion – and a judgment lien calculator — see above in the Chapter 7 judgment lien section.

What is Cramdown in Bankruptcy (Chapter 13)?

Chapter 13 bankruptcy cramdown is where we can reduce the secured debt of a car to the fair market value of the vehicle. In other words, in Chapter 13, we can “cram down” the loan balance to what the car is worth if the loan was incurred over 910 days ago. The remaining debt gets paid through the Chapter 13 plan at the same percentage as the unsecured debt, potentially saving thousands of dollars on a vehicle loan.

A bankruptcy cram down example would be if a vehicle loan was $30,000, and the car was only worth $18,000. In Chapter 13, it’s possible to only pay $18,000 for the car loan, and treat the rest of the car debt like credit card debt. Again, this wouldn’t make a lot of sense if it’s a 100% plan or there is some doubt you’ll be able to finish the bankruptcy with the car “in the bankruptcy” because if the case is dismissed, you’re now late on the loan which was being partially paid through the case, which is now ended. You’ll need to ensure you can get to the finish line if you take this route. However, the benefit can be valuable.

Also, you can cramdown a car title loan and you don’t have to wait 910 days, since it wasn’t a purchase-money security interest (PMSI).

The lenders in a cramdown case get Till interest rates. This is typically prime interest rate, plus 1 to 3 percent. As the Fed raises interest rates, the prime rate is around 9%, so this could be more expensive than not doing a cramdown. See a bankruptcy lawyer to find if this is best for you.

Speaking of what is PMSI and non-PMSI, let’s talk about Penrod.

Penrod and Negative Equity

Is The Negative Equity PMSI?

Penrod is not just a funny name, but a Ninth Circuit case. The Penrod case addresses trade-ins which had the old loan rolled into the new one, where the old loan is now called negative equity. We just learned that we can cram down a vehicle loan if the balance is more than the vehicle’s value if the debt was incurred over 910 days prior to filing. There is a way to remove the traded-in loan from the current loan, even if this happened in the 910 days before filing.

Marlene Penrod traded in an Explorer and bought (and financed) a 2005 Ford Taurus. She rolled about $7,000 of her old Explorer loan into the new Taurus financing. Less than 910 days later, she filed Chapter 13 bankruptcy. In the case, she bifurcate, or split, the Taurus loan into two, and said she’d only pay the new Focus price in full as Purchase Money Security Interest (PMSI). The negative equity from the Explorer wasn’t purchase money, and therefore wouldn’t be secured.

The new finance company objected, and the Ninth Circuit Court of Appeals agreed with Marlene Penrod when it wrote, “In sum, we find that a creditor does not have a purchase money security interest in the “negative equity” of a vehicle traded in during a new vehicle purchase.” In re Penrod, 611 F. 3d 1158 (9th Cir, 2010).

Penrod and Gap Insurance and Extended Warranties

Not only can negative equity can be removed from a vehicle loan in a Chapter 13 in the Ninth Circuit, other bankruptcy courts in the circuit have broadened this to other areas. For example, in Washington state, a bankruptcy court has held that Penrod also applies to removing gap insurance and an extended warranty. This is because, like negative equity, they are not part of the purchase money security interest. In re Jones, 583 BR 749 (WDWA, 2018).

In Jones, the court ruled:

Accordingly, this Court finds the Option Contracts are not part of the “price” of the Vehicle secured by the PMSI. Like negative equity, the Option Contracts are not sufficiently related to the purchase of the Vehicle. Unlike other expenses listed in Official Comment 3, neither the purchase of optional gap insurance or maintenance contracts are akin to sales tax and license fees, which are not optional but are required in order to obtain the vehicle.

Jones at 755.

It went on to write, “The Court concludes that Kitsap Credit Union’s purchase money security interest in the Vehicle does not secure sums advanced to pay for optional gap insurance and vehicle maintenance contracts.” Id. at 759.

Tax liens in Bankruptcy

Tax liens in bankruptcy generally don’t go anywhere. In Chapter 7, because they didn’t get paid, they survive the bankruptcy case. A tax lien in bankruptcy (Chapter 13) will have to be paid as a secured debt to avoid it and remove it. This can create feasibility problems in your Chapter 13 bankruptcy case, depending on the size of tax lien and secured debt. As always, discuss with a bankruptcy lawyer.

In sum

Liens in bankruptcy are generally not removed, and you don’t get a free car or house. Sometimes liens can be reduced, stripped, or avoided, if the math works out right in various situations. There is a lot more flexibility in Chapter 13 bankruptcy to reduce or even eliminate liens. Arrange a consultation with an experienced bankruptcy attorney in your area to learn your particular options. Thanks for reading.