Table of Contents

Bankruptcy Discharge Exceptions of 523: Explained in Simple Terms

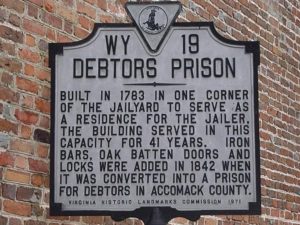

In bankruptcy, debt is discharged unless there’s an exception that makes it nondischargeable. That’s the rule: all unsecured debt is eliminated in bankruptcy unless the exception is in Section 523 of the Bankruptcy Code. What kind of things are listed there? You can guess: recent taxes, most student loans, and so on. Here’s a look at the the bankruptcy discharge exceptions of 11 USC 523.

The statute: 11 USC 523(a)

The rule is all unsecured debt goes away in bankruptcy, and 11 USC 523(a) is the list of exceptions to the rule. In some cases, there are exceptions to the exceptions. That is, the list below is not absolute; sometimes debts in 523a can be discharged in bankruptcy.

Before launching into the long list, Section 523(a) of the Bankruptcy Code says:

A discharge under section 727, 1141, 1192 [1] 1228(a), 1228(b), or 1328(b) of this title does not discharge an individual debtor from any debt:

That’s the preamble. It basically says that a discharge in Chapter 7 bankruptcy, Chapter 13 bankruptcy, Chapter 11 or Chapter 12 bankruptcy doesn’t eliminate the following debts.

Rather than copy and paste the entire many pages of exceptions to discharge, we’ll try to summarize them, and give a short explanation. You’re encouraged to read the Code for the exact phrasing of the law, research the case law for each, and meet with a bankruptcy attorney.

Here’s one bankruptcy attorney’s attempt to summarize the nondischargable types of debts in bankruptcy.

Exceptions to Discharge of Section 523

- priority tax debt

- debt obtained by false pretenses or fraud

- unscheduled debt you don’t list in your bankruptcy

- breach of fiduciary duty, embezzlement, and larceny

- domestic support obligation like alimony or child support

- willful or malicious done to someone or their property

- fine or penalty owed to a government

- student loan debt

- DUI causing a death or injury

- debt not discharged in a prior bankruptcy case

- FDIC fraud or breach of fiduciary duty

- malicious or reckless failure to protect FDIC assets

- federal restitution

- debt incurred (eg: credit card) to pay a tax debt (but Chapter 13 is ok)

- debt to a child or (former) spouse during divorce that’s not DSO

- HOA fee or assessment

- prisoner’s legal fees to determine their status

- retirement loan

- securities laws or fraud involving securities

- debt owed to someone for human trafficking violations

What it all means

Again, this is a grossly simplified summary of the law, and you’ll want to do more thorough research. Generally speaking, if it’s a debt that’s not on the exceptions to discharge list of 11 USC 523, then the debt is dischargeable in bankruptcy.

What if it is on the list?

In some cases, there are exceptions to the exceptions. For example, some tax debt can be discharged in bankruptcy, but the tax has to meet very strict criteria. Student loans also have an even-harder-to-qualify exception to allow discharge in bankruptcy, even though there’s hope that’s being eased, or perhaps simplified, with current DOJ guidance on student loans.

Remember also, you don’t get a free car in bankruptcy. If you have a secured debt like a car or house or collateral with a lien and you want to keep it, you need to stay current on that debt during and after the bankruptcy, and you may need to enter into a reaffirmation agreement.

What if I don’t understand if my debt will qualify?

If you’re not sure whether your debt qualifies, please consult with an experienced bankruptcy attorney. While this is a very simple list, bankruptcy is an extremely complicated area of law with much litigation. If you’re in the greater Los Angeles area or surrounding counties, contact me and let’s have a Zoom consultation.