Table of Contents

Student Loans and Bankruptcy

2022 update: the Biden administration has just told its DOJ to recommend student loan discharge in some bankruptcy cases, which won’t need Congress to cooperate. Also, a student loan bankruptcy may be a possibility with the Fresh Start Through Bankruptcy Act (aka “Fresh Start Bill”) currently in the Senate.

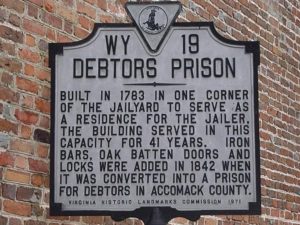

The student loan crisis is bubbling just under the surface. Many leave college with no jobs and unable to afford the debt. So no wonder people are wondering about student loans and bankruptcy. In a way, it’s becoming somewhat of a modern debtor’s prison.

General rule of student loans and bankruptcy

Student loans, generally, are not dischargeable under any chapter of the Bankruptcy Code.

A bankruptcy case can, however, eliminate other debts that are competing for your dollars and provide a measure of peace during a Chapter 13 plan. Further, in a Chapter 13 bankruptcy, some courts permit the debtor to separately classify a student loan so that a greater percentage of disposable income goes to the student loan than non-secured debt.

Exception

There is an extremely narrow exception to student loans. The borrower would have to show “undue hardship.” This determination is for a judge to rule, but is usually made by a combination of factors.

Factors for “Undue Hardship”

Those who file bankruptcy in California are subject to the laws as interpreted by the Ninth Circuit. The Ninth Circuit follows the test for undue hardship set forth in the cases of In re Brunner, In re Shankwiler and In re Pena. These say in order to demonstrate hardship for purposes of discharging a student loan, three criterion must be met. Firstly, the debtor must prove that he/she cannot maintain a minimal standard of living if forced to repay the student loans, based upon current income and expenses. Secondly, that additional circumstances exist indicating that this state of affairs is likely to persist for a significant portion of the repayment period. Lastly, that the debtor made a good faith effort to repay the loans.

The court is required to exercise its discretion in determining whether and undue hardship does in fact exist.

First the courts will look to the net monthly income and subtract out reasonable monthly expenses.

Then it will look to see whether the debtor profited in the work force by his education and whether the debtors earning potential was increased by the education.

Lastly the court will look to see what efforts the debtor made to repay the loans, and whether the debtor had requested a deferment or not.

The inquiry is guided by the idea that the debtor was just unfortunate. That is, the bad financial condition and default should not have been caused by the debtor’s own willfulness or negligence. Instead, the situation was caused by factors beyond the debtors control. Each case will of course turn on its own facts and it will be incumbent upon the debtor’s attorney to convince the court that “undue hardship” does in fact exist in the debtor’s case.

Bottom line: your student loans and bankruptcy aren’t a likely solution. However, at least you’ll better be able to afford them.